Ares Capital Corporation: A Masterclass in Private Credit Excellence

A Comprehensive Guide to Ares Capital Corporation's Record-Breaking Q3 2024 Performance and What It Means for Investors

Introduction: A Trailblazer in Private Credit

Imagine navigating the financial world like a seasoned chess master, anticipating moves and strategizing to stay ahead. That’s Ares Capital Corporation (ARCC) in a nutshell—a leader in the business development company (BDC) space. With 20 years under its belt, ARCC combines expertise, scale, and innovation to deliver returns that outpace the S&P 500. Let’s explore how ARCC performed in Q3 2024 and why it continues to be a compelling player in the private credit market.

The Numbers Behind the Success

Key Financial Highlights

ARCC’s Q3 2024 results showcased resilience and strategic prowess:

Net Income: $394 million, or $0.62 per share, versus $0.89 per share in Q3 2023.

Core EPS: A steady $0.58, reflecting robust operational earnings.

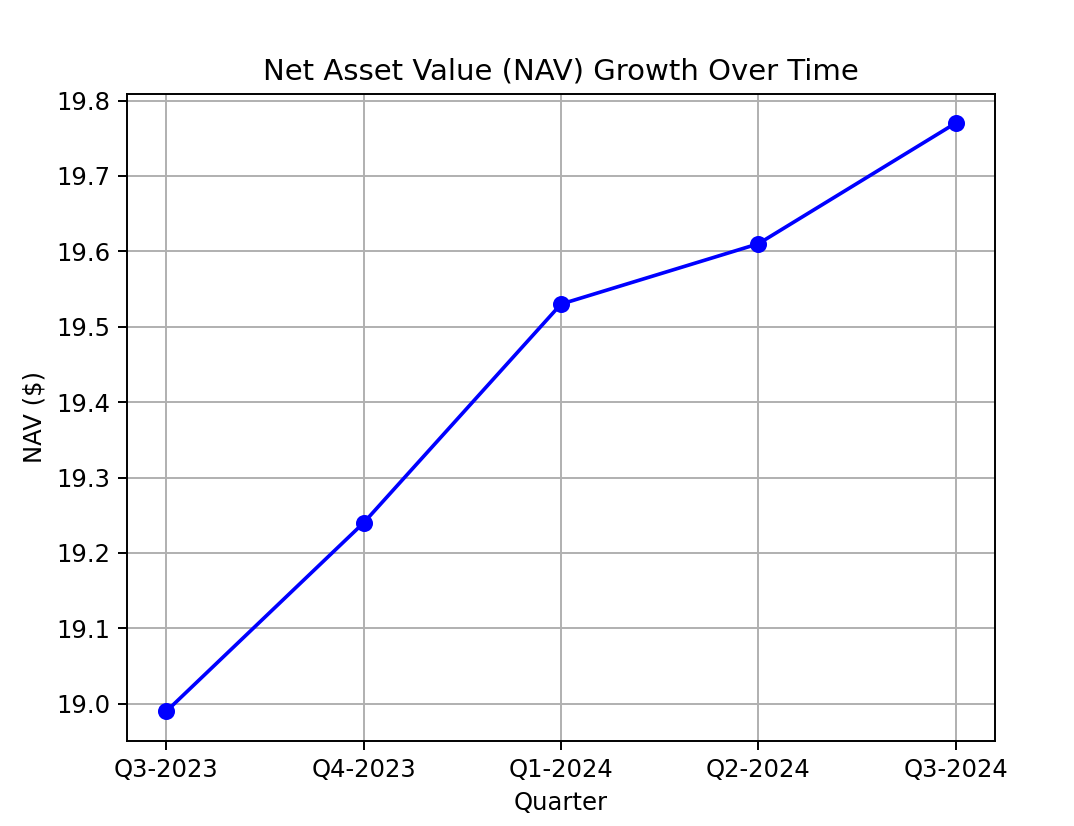

Net Asset Value (NAV): Climbed to $19.77 per share, up from $19.24 at the start of 2024.

Portfolio Performance

Total Investments: $25.9 billion, up from $22.9 billion in December 2023.

Portfolio Companies: Increased to 535, emphasizing diversification.

Yield on Investments: Averaging 10.7% at amortized cost, reinforcing income generation.

(Graph 1: "NAV Growth Over Time" )

What Makes ARCC a Standout?

1. A Portfolio That Stays Diverse

ARCC’s portfolio spans industries, from software to healthcare, reducing reliance on any single sector. Diversification not only mitigates risk but also positions ARCC to capitalize on emerging trends.

25% of its portfolio is dedicated to software and services, while healthcare accounts for 13%.

2. Risk Management Expertise

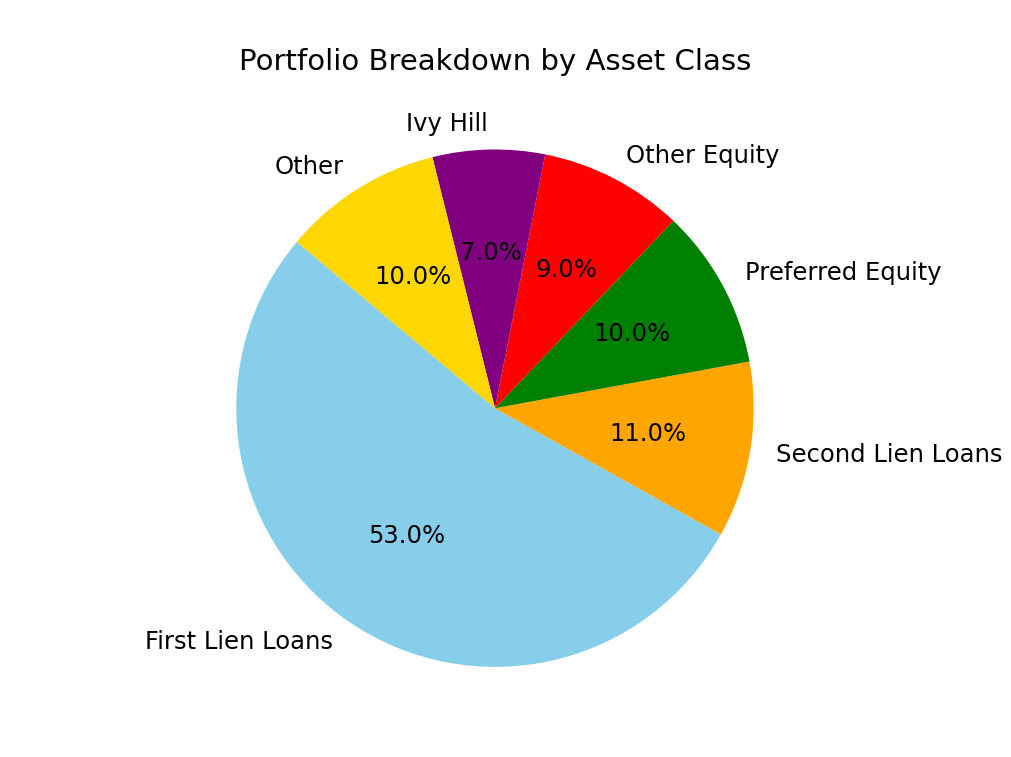

ARCC invests predominantly in first-lien senior secured loans (53% of its portfolio), offering strong downside protection. With only 0.6% of its investments on non-accrual status, ARCC underscores its disciplined approach.

(Graph 2: "Portfolio Breakdown by Asset Class")

Why Investors Are Drawn to ARCC

1. Consistent Dividend Payments

ARCC has paid quarterly dividends for over 15 years, with a current rate of $0.48 per share. Its investment-grade ratings and conservative leverage (1.06x debt/equity) ensure reliability.

2. Leveraging Scale and Relationships

With $464 billion in assets under management across Ares Management, ARCC benefits from unmatched deal flow and an information edge in middle-market direct lending.

A Look Ahead: ARCC’s Growth Strategy

Expanding Market Opportunities

The U.S. middle-market lending space—valued at $5.4 trillion—offers ARCC ample runway for growth. As traditional banks retreat, direct lenders like ARCC fill the void, offering tailored solutions to borrowers.

Commitment to Innovation

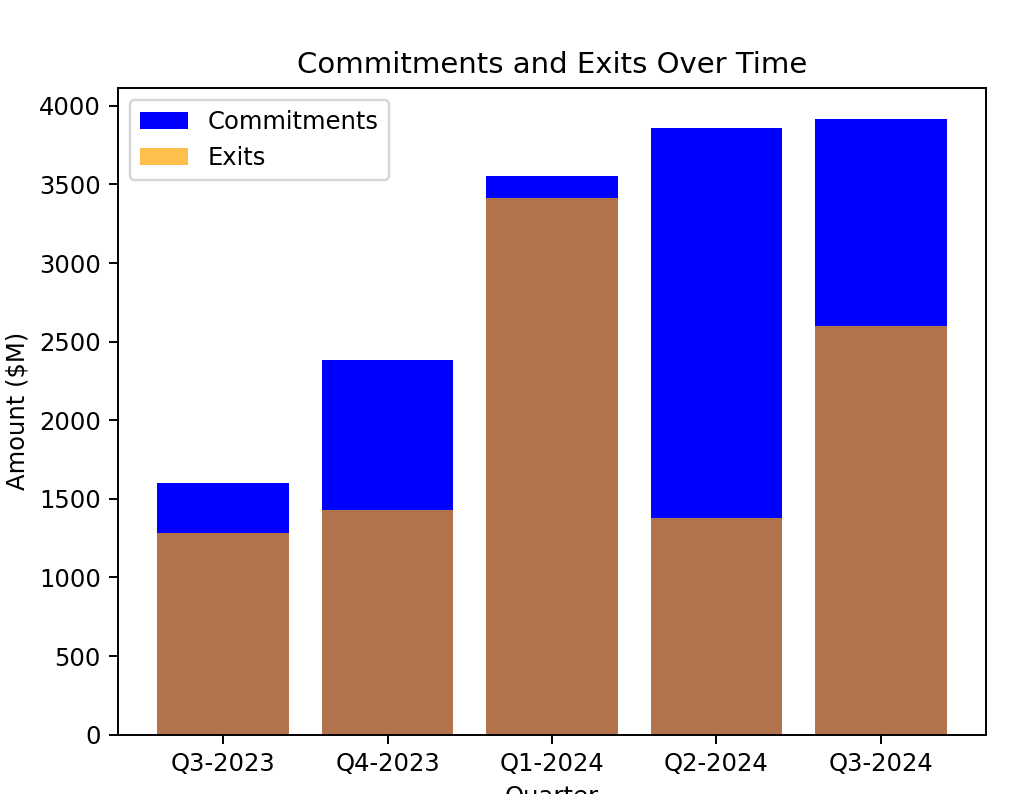

In Q3 2024, ARCC made $3.9 billion in new investment commitments, with a focus on floating-rate loans to hedge against inflation. Its adaptability ensures it remains competitive regardless of economic cycles.

(Graph 3: "Commitments and Exits Over Time")

Why ARCC Belongs in Your Portfolio

For investors seeking a mix of income and stability, ARCC checks all the boxes. Its proven track record of delivering 13% annualized stock returns since inception and commitment to shareholder value make it a standout in the BDC sector.

Conclusion

ARCC exemplifies the power of disciplined management, diversification, and innovation in driving shareholder value. As it continues to adapt to changing market dynamics, it remains a beacon of reliability and growth for investors.

Disclaimer: This article is for educational purposes only. Please conduct your own research or consult a financial advisor before making investment decisions.