Wal-Mart de México: The Underrated Stock That Could Boost Your Portfolio

Why Wal-Mart de México is the Hidden Gem Every Value Investor Should Know About

When it comes to investing, most people chase shiny, overvalued stocks or hot markets. But what if I told you there’s a stable, under-the-radar opportunity in Mexico—a country benefiting from proximity to the U.S. and growing economic tailwinds?

Enter Wal-Mart de México y Centroamérica (WALMEX), a hidden gem in the retail sector. This stock offers a unique blend of steady dividends, growth potential, and exposure to a transforming economy.

In this article, we’ll explore why WALMEX is a must-watch for value-driven investors. We’ll dive into its operations, financial performance, growth drivers, and risks, all while giving you practical takeaways to build a smarter portfolio.

Why Invest in Mexico?

A Surprisingly Stable Economy

Mexico is more than just sun-soaked beaches and tacos. Despite its modest GDP growth, the country boasts economic stability and is poised for significant industrial gains.

With global manufacturing pivoting away from China, Mexico is emerging as a prime destination for nearshoring. Tech giant Nvidia, for example, is building a superchip facility in Mexico—a clear sign of confidence in the country’s infrastructure and labor force.

Value Investing in Action

As Jeremy Siegel explains in The Future for Investors, "The best-performing markets aren’t always the fastest-growing ones." Mexico fits this narrative perfectly, offering low-cost opportunities compared to overhyped markets like China.

WALMEX: A Retail Powerhouse

Market Dominance

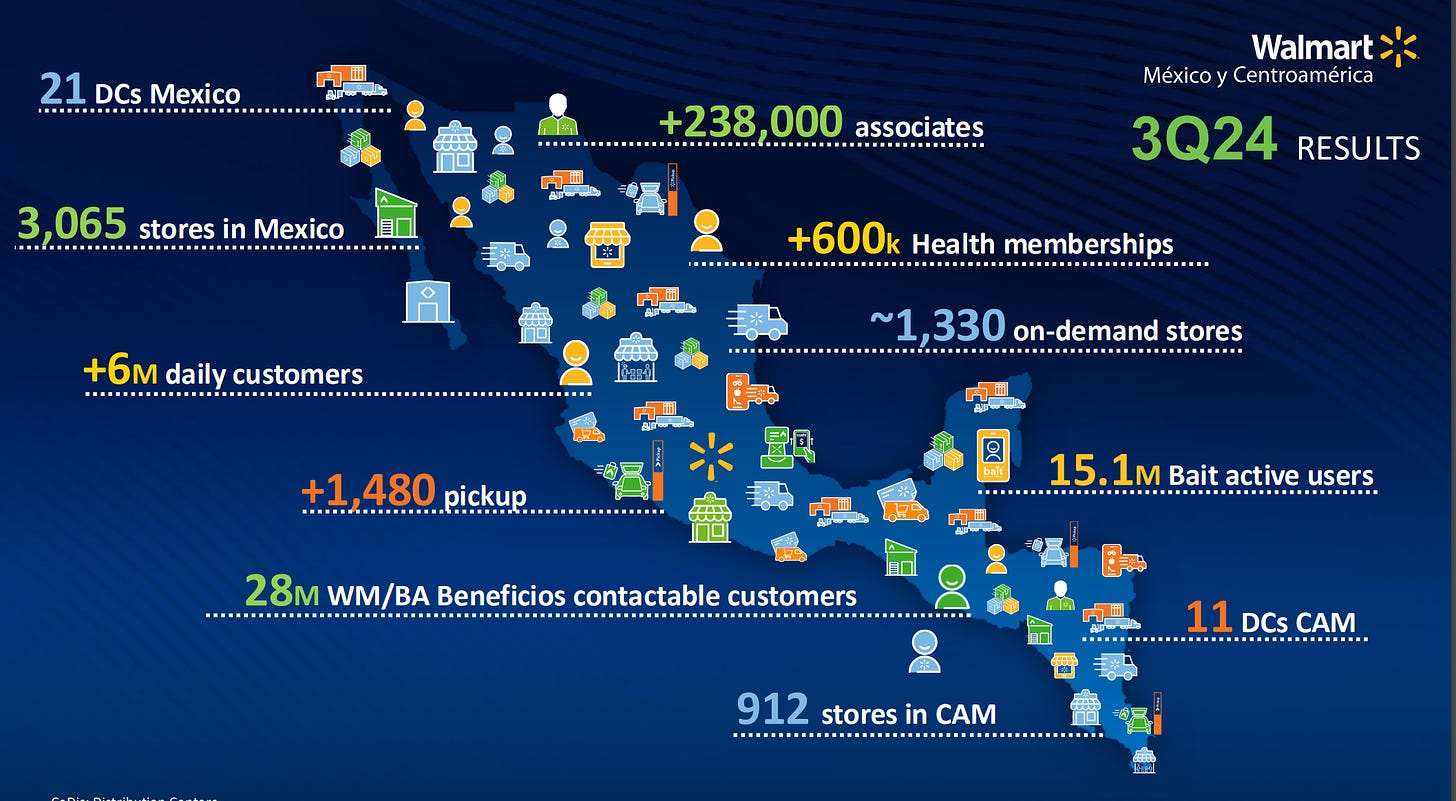

WALMEX operates a vast network of stores across six countries in Latin America, including Mexico, Guatemala, and Costa Rica. From its flagship Walmart Supercenters to budget-friendly Bodega Aurrerá, WALMEX has captured the hearts and wallets of consumers.

Leveraging Walmart’s Global Expertise

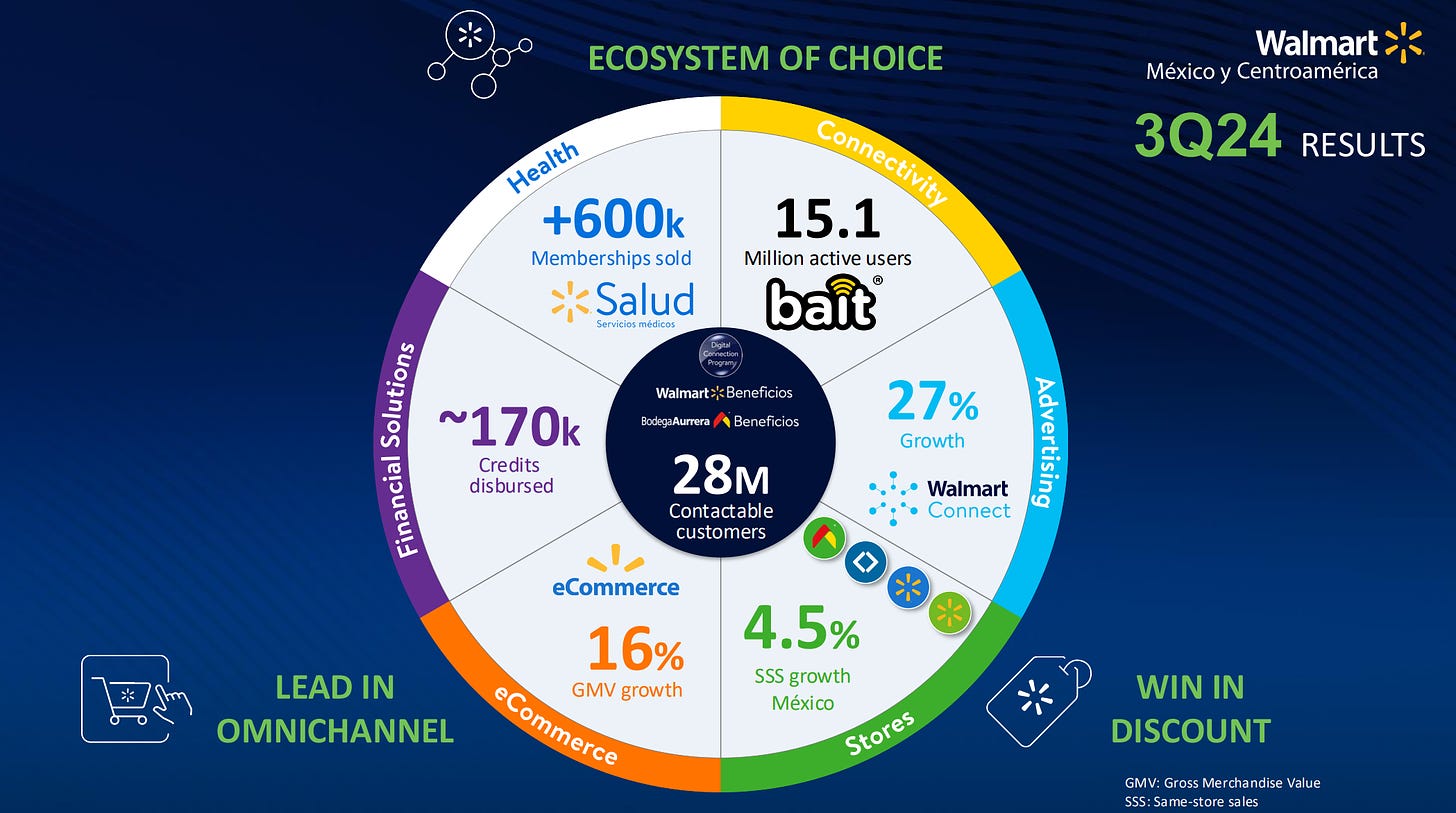

Thanks to its parent company’s advanced logistics, WALMEX enjoys a competitive edge over rivals like Soriana and Chedraui. It’s not just a retailer—it’s an ecosystem that connects physical stores, e-commerce, and digital services.

Breaking Down the Numbers

Stellar Q3 2024 Performance

Revenue Growth: Consolidated revenue increased 8%, driven by 6.1% growth in Mexico and 4.6% in Central America.

Same-Store Sales: WALMEX’s Mexico same-store sales grew 4.5%, reflecting a rise in ticket size by 5.5%, even as store traffic dipped slightly

Omnichannel Excellence: E-commerce sales jumped by 16%, with significant contributions from its "Pronto" delivery service and expanded product assortment.

Dividend Yield

Currently, WALMEX trades at a price-to-earnings ratio of 17.85 and offers a starting dividend yield of 3.5%. For U.S. investors, currency fluctuations may impact the exact yield, but it remains a strong value play.

Why WALMEX Is a Contrarian Pick

Discounted Valuation

Unlike many global stocks trading at record highs, WALMEX is near its 52-week low. This makes it a great contrarian play, combining blue-chip stability with the potential for a rebound.

Future Growth Catalysts

Omnichannel Expansion: WALMEX’s e-commerce operations are scaling rapidly, with innovations like "90-minute delivery" and enhanced app functionality driving customer loyalty.

Automation and Efficiency: The company is building fully automated distribution centers, which will reduce costs and improve supply chain reliability.

Economic Tailwinds: Nearshoring trends and increased industrial activity in Mexico are long-term growth drivers.

Risks to Consider

Exchange Rate Fluctuations

Currency volatility could reduce returns for foreign investors. While the weak Peso currently makes Mexican stocks cheap, sudden swings could impact dividend payouts.

Retail Competition

WALMEX operates in a fiercely competitive sector. Rivals like Chedraui and regional e-commerce platforms are constantly vying for market share.

Is WALMEX Right for You?

If you’re looking for a stock that combines stability, growth, and dividend potential, WALMEX deserves your attention. It’s perfect for investors with a contrarian mindset and a long-term view.

Final Thoughts

WALMEX isn’t just a stock; it’s a strategic bet on Mexico’s economic transformation. With its strong market position, growing omnichannel presence, and solid dividend yield, it offers a rare combination of value and growth.

Disclaimer: This article is for educational and entertainment purposes only. It is not financial advice. Always consult a professional before making investment decisions.